Source: cision | Published on: Wednesday, 10 December 2025

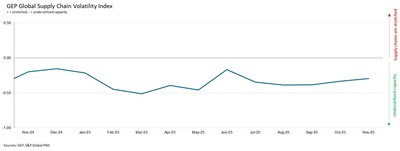

CLARK, N.J., Dec. 10, 2025 -- GEP Global Supply Chain Volatility Index, a leading economic indicator based on a monthly survey of 27,000 businesses, shows that global supply chains remained underutilized in November, with manufacturers continuing to limit purchasing, signaling a weakening outlook for the start of 2026.

The headline index came in at –0.29, signaling another month of slack capacity across global suppliers. The sharpest pullback occurred in North America, where the regional index fell, driven by a contraction in input demand as manufacturers cut orders ahead of the new year.

Asia continued to report underutilized supply chains, as firms held back on purchasing, driven largely by a further pullback in Chinese factory buying amid soft global demand. However, there were pockets of strength across the region, particularly among the ASEAN nations.

Across Europe and the UK, spare capacity ticked higher as demand fragility persisted. Factories in Germany and France once again displayed a reticence to expand purchasing, instead opting to make more aggressive cutbacks.

With excess capacity firmly in place globally, the data suggest companies will face limited purchasing cost pressures in the months ahead, excluding tariff-related effects. Shortages remain minimal, stockpiling activity low, and manufacturing backlogs largely flat, highlighting a supply landscape still characterized by slack rather than strain.

"Companies are watching the U.S. Supreme Court closely, and most expect a pause or rollback in tariffs," said John Piatek, Vice President, Consulting, GEP. "With supply chains this slack, it remains a buyers' market heading into 2026, and companies have real leverage to secure favorable terms for the year ahead."

NOVEMBER 2025 REGIONAL KEY FINDINGS